Table of Contents

Overview & Problem #

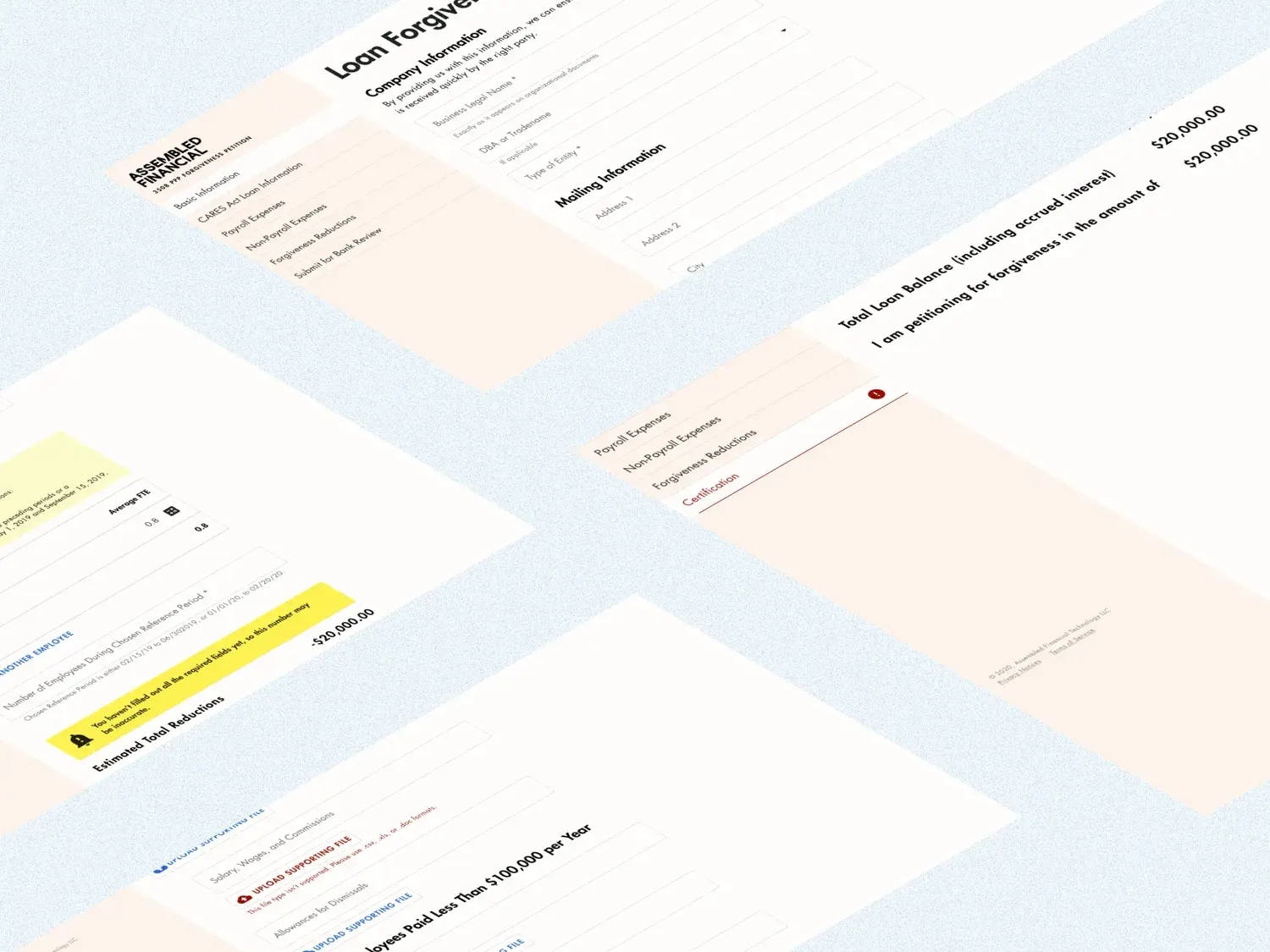

Assembled Financial needed a highly automated lending platform to help customers navigate loan forgiveness through the CARES Act during the pandemic.

The challenge:

- A massively complex and evolving 55-page federal form

- Customers under intense stress, needing clarity and support

- Lenders requiring tools to review and approve applications efficiently

The task was to simplify and humanize the process while ensuring compliance, accessibility, and adaptability as regulations shifted.

Role #

I was the founding designer on this project, working over 6 months alongside:

- 2 project managers

- 6 engineers

- Industry experts, including direct counsel from the U.S. Treasury

Contributions included:

- Leading design for both borrower- and lender-facing experiences

- Establishing a scalable design system and component library

- Hiring and onboarding Assembled Financial’s first designer

- Acting as part of a long-term product team through multiple releases and pivots

Approach #

Decode complexity #

Working closely with subject matter experts, the product manager and I broke down the federal loan forgiveness workflow and rebuilt it for clarity and accessibility.

- Transformed tiny, inaccessible PDF fields into clean, modern, web-based inputs.

- Enabled localization for multiple languages.

- Automated generation of completed, review-ready PDFs.

Help lenders and borrowers both #

The platform needed to serve both sides of the process:

- Borrowers: a guided, user-friendly flow to reduce stress and error

- Lenders: a non-linear interface that supported reviewing, messaging, and approvals

We built a robust lender dashboard with messaging capabilities, enabling advisors to collaborate with customers before final submission.

Behind the scenes, I created a flexible design system in Figma that empowered PMs and engineers to prototype and adapt workflows quickly as requirements evolved.

Pivoting #

Though we moved fast, the product couldn’t launch before CARES Act funds were depleted. We pivoted to a white-label loan forgiveness solution with lender- and customer-facing interfaces, extending the product’s impact beyond the initial program.

Results #

- Adopted by several financial institutions as a white-label forgiveness platform.

- Helped thousands of borrowers successfully apply for loan forgiveness.

- Supported small businesses in staying afloat during one of the most challenging economic periods in recent history.

- Established a scalable foundation for Assembled Financial’s design practice and product growth.